Solid first half; strong operations, strong cash flow

We continue to position BP for the new oil price environment, with a continued tight focus on costs, efficiency and discipline in capital spending. We delivered strong operational performance in the first half of 2017 and have considerable strategic momentum coming into the rest of the year and 2018, with rising production from our new Upstream projects and marketing growth in the Downstream.

Bob Dudley, group chief executive

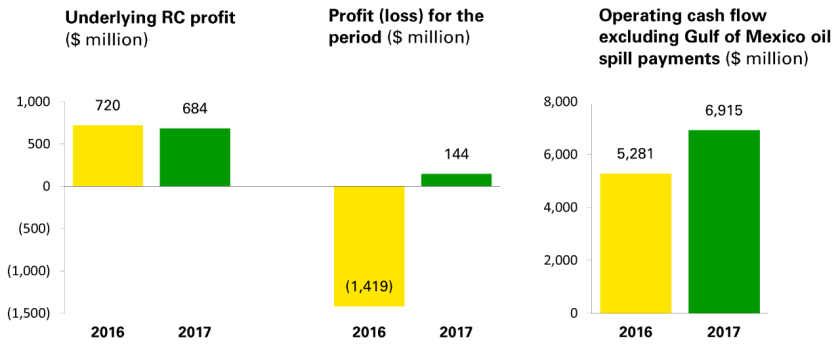

- Underlying replacement cost (RC) profit* for the second quarter was $0.7 billion.

- Second-quarter operating cash flow, excluding Gulf of Mexico oil spill payments*, was $6.9 billion. Including these payments, operating cash flow* for the quarter was $4.9 billion.

- Dividend unchanged at 10 cents per share.

- Second-quarter Upstream production was 10% higher than in the same period in 2016; first-half production was 6% higher.

- Upstream major projects on track; two new projects sanctioned in quarter; significant gas discoveries in Senegal and Trinidad announced; $753 million exploration write-off, predominantly in Angola.

- In Downstream, first-half fuels marketing earnings around 20% higher than in the first half of 2016.

* See definitions in the Glossary on page 32. RC profit (loss), underlying RC profit, cash flow excluding Gulf of Mexico oil spill payments, organic capital expenditure and net debt are non-GAAP measures.

%20(1).png)